The rising middle class will be an attractive market for NZ aquaculture products.

To understand the opportunities and issues for New Zealand it is useful to consider the global trends and issues in the seafood and aquaculture sector.NZ must carefully consider how it will compete in future domestic and export markets with rapid globalisation and shifts in economic dominance and demographics creating game changing scenarios.

Globally, seafood is one of the most highly traded food commodities. Demand for seafood is set to rise substantially but supply from catch fisheries has stagnated and will not increase significantly. Aquaculture already provides half of all seafood supplies and only aquaculture can increase production to keep pace with the growing seafood demand.

Despite rapid expansion for several decades, the rate of aquaculture growth is now slowing. Many factors contribute to this trend, but one main factor, funding, is the major constraint on growth. Funding for aquaculture development has become the critical issue to industry expansion.

Between USD 100-130 billion is required to cover production for the projected supply shortfall of at least 50 million metric tonnes by 2030. In the shorter-term, the shortfall is predicted to be 16 million metric tonnes by 2020, which will need capital of between USD 30-40 billion to reach required production. Approximately USD 20 billion of this is needed for China alone.

The capital for aquaculture expansion will need to be met by internal investment. Large companies that are able to tap the capital markets and governments willing to offer incentives for investments will both be essential for this to be achievable. In many cases, business involved at the retail level of the value chain will need to invest in aquaculture production to ensure supply, price, quality and safety. This trend is already emerging (Darden/Red Lobster and Walmart).

The key TRENDS and ISSUES in aquaculture are:

The future value chain for seafood will be quite different. Over the next 10-20 years, the seafood market will change to become more of a seller’s market than a buyer’s market. Seafood demand will increase faster than aquaculture supply. Supply constraints will fuel price increases.

Aquaculture will rely on price increases to drive expansion. De-risking aquaculture will play an important part in making aquaculture a more attractive investment, but price increases for aquaculture products will be the key driver behind future investment in aquaculture and increases in supply.

Aquaculture has many hurdles to overcome.

The key constraints are:

Aquaculture production has proved to be highly resilient to the many problems that it has faced in what must be considered its emergence and early rapid growth phases. Based on this tenacious history and the new technologies and opportunities available, it is unrealistic to predict that aquaculture will not continue to expand both in terms of production and species offering. The important question is “can NZ be a part of this aquaculture growth”?

The significant change from the earlier phases of aquaculture development will however be slower growth, where supply will, in many cases, lag behind demand. Many historic aquaculture species developments have been “production driven”. These species developments, notably Atlantic salmon, seabass, seabream, pangasius and tilapia, have exceeded market demand and suffered from massive price collapses that have created turmoil within the industry. This cyclical pattern of production capability overshooting market demand is the hallmark of aquaculture production over the last 30 years. As funding becomes a more important constraint on growth, this cycle is unlikely to continue into the future.

The aquaculture industry will become more “market driven”. Production and especially the expansion of production will follow markets that are prepared to pay a premium for a particular species within particular regions or competitive prices on the global commodity market. If the market is not prepared to pay a price that generates an attractive return to farmers and investors, the supply will not eventuate and will certainly not grow.

The market demand in specific regions and the preparedness of markets to pay the best price in the global trade of seafood and aquaculture supplies will determine where aquaculture production flows in the future. Many developed markets will have difficulty competing with prices and returns offered by intraregional trade in the developing regions that will themselves produce the bulk of seafood supply. Japan is already experiencing this issue with seafood supply. China and some other Asian countries are prepared to pay higher prices for many seafood items than Japan. This is especially true for premium seafood. China and Asia are “climbing the luxury ladder” and Japan is experiencing constriction in supply of many traditionally favoured seafoods.

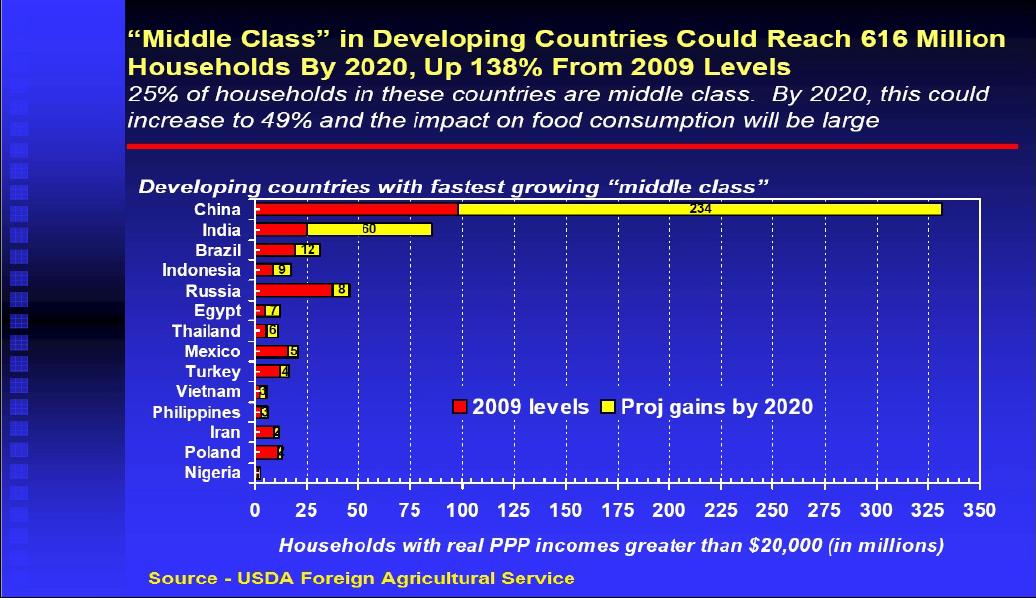

The growing middle class in developing regions and the sheer number of “wealthy” in these regions will make these markets more attractive for aquaculture producers to sell into. The efficiencies of intraregional trade, which will not necessitate transcontinental shipments and have simpler logistics, will further fuel growth in intraregional trade.

The rapidly growing middle class with rising disposable incomes will favour NZ aquaculture exports of specific products. The growing middle class in our neigbouring Asian region must not be ignored as this demographic will shape the future of aquaculture in the region and NZ must be a part of this trade.

The intraregional trade will leave developed regions such as the EU and the US at a disadvantage in obtaining future seafood supplies. As prices rise and supply dwindles, developed regions will entertain new production and supply paradigms to meet demand. These models may include RAS, “in market” production, open ocean aquaculture, investments in tropical aquaculture and a shift to accept non-traditional species. NZ has a good opportunity to supply aquaculture product to the developed regions in the future.

Global warming will further exacerbate supply in developed regions. Production from temperate regions will be negatively affected by global warming while the production from tropical regions will be benefited. Developed regions in temperate zones will be compelled to consider land based RAS production systems to meet finfish supply demands and this will be the case for NZ.

Furthermore, intraregional trade in developing regions will become progressively tailored to its specific market preferences within each region. This will further realign and displace the match between the bulk of global aquaculture production and the market preferences in developed regions.

It may eventuate that the developing regions progress the capability to service the developed regions, as well as their own intraregional trade, if prices remain attractive. With adequate funding, the productive capacity within tropical regions is adequate to achieve this. For this to occur it is likely that key players in the value chain of developed regions will need to invest in production in developing tropical regions to ensure supply of the species they require at the right price, to the quality/food safety their consumers demand and to the required standards of sustainability.

New Zealand must carefully consider the threats and opportunities presented by the changing dynamics of future seafood markets, production and supply networks. Three strategies emerge for NZ aquaculture producers: